|

|

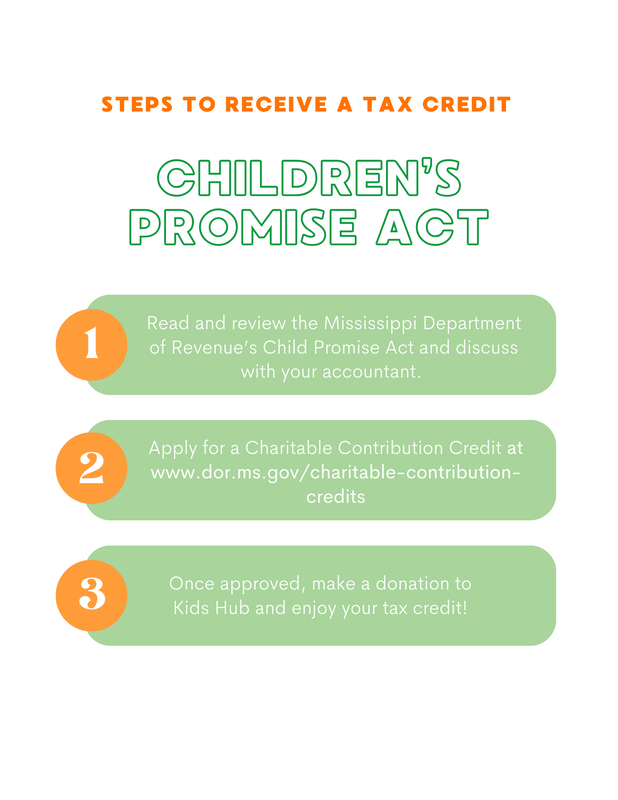

A tax credit is available for voluntary cash contributions to eligible charitable organizations (“ECO”) and educational services charitable organizations (“ESCO”). Miss. Code Ann. § 27-7-22.41. Each credit has different requirements related to which organizations can qualify and how credits are allocated to each taxpayer. Please see the information related to each credit type below.

Information for ECO Credits Total Maximum Allocation: $9,000,000 Limits on Total Allocations per ECO: 25% of the maximum allocation ($2,250,000) Who can Qualify as an ECO: Organizations either licensed by or under contract with the MS Department of Child Protection Services and that provide services related to adoption and/or foster care related activities Who can Apply for an Allocation of Credit: Business Taxpayers (Corporations, Partnerships, Limited Liability Companies, and Sole Proprietorships) Tax-Types that Credit can be used against: Income Tax (50% of tax liability), Insurance Premium Tax (50% of tax liability), Insurance Premium Retaliatory Tax (50% of tax liability), Ad Valorem Tax (for entities not operating as a corporation, 50% of real property tax liability) Carry Forward: 5 years Other Limitations: Contribution cannot be used for other state charitable credits and cannot be used as a deduction for state income tax purposes |

CONTACT US |

Hattiesburg Office15 Millbranch Rd.

Hattiesburg, MS 39402 Monday-Friday 9AM-5PM |

Columbia

|